FDI flows to Asia: No size too small

It was reported that Sri Lanka’s US$1.6 billion foreign direct investment (FDI) in 2017 was double the amount reported in the previous year and, was the highest that the country has ever received.

Today I intend to talk about, not the Sri Lankan record last year, but the “world record of FDI flows.” In doing so I want to emphasise the point that we are passing through, or perhaps passing by, the “best time” of our history.

In fact, for a number of external and internal factors I have reiterated many times that Sri Lanka has received in the last few years the best opportunity to achieve its rapid growth momentum that it ever had during its post-independent history. The point I emphasise today is just one of these factors which formed the “best time” for us.

World FDI: How big it is?

The World Investment Report 2017 of the UNCTAD reported, total world FDI flows were expected to be around $1.8 trillion in 2017. It was recorded as $1.75 trillion in 2016. The highest figure close to $2 trillion was reported in 2007, just before the global financial crisis in 2008-2009. There is a reason for that which I expound later.

Our big neighbour, India has become among the top-10 FDI-recipient countries in the world and recorded $44 billion FDI inflows in 2016. In fact all four BRIC countries (Brazil, Russia, India and China) are among the top-10 FDI-recipients. Nevertheless, just by looking at this it is wrong to argue that FDI flows more to bigger countries than to smaller countries.

Hong Kong, Singapore and the Netherlands are small countries, and are smaller than Sri Lanka too. All these three countries are among the top-10, while their FDI inflows are even greater than that of India. Hong Kong with 7 million people has received $108 billion FDI, while Singapore with 5.6 million people has received $62 billion FDI. Netherlands with 17 million people has also attracted $92 billion FDI.

Size doesn’t matter

Some foreign investments do seek big markets or abundant unskilled labour so that “being big” is an advantage for big countries like India to attract such investment.

However, smaller nations can overcome the limitation of the smaller domestic market by integrating competitively with the global market and with the bigger nations.

They can overcome even the labour shortage by setting up the regulatory mechanisms to attract foreign labour. Some countries in East Asia, West Asia and the Pacific region have done well. In many West Asian countries, the foreign workforce is even bigger than their native population.

After all, the size of the country does not determine the size of FDI flows. Apart from “being big”, smaller nations still have many other areas to become competitive with bigger nations, as confirmed by FDI flows to Hong Kong, the Netherlands and Singapore.

Obviously, the types of FDI flows into these countries do not seek abundant cheap labour but other favourable conditions including the “quality” of labour. We should also not forget that with established economies open to the global markets, their market size is not bound by the territorial boundaries.

FDI: Growing fast and turning to Asia

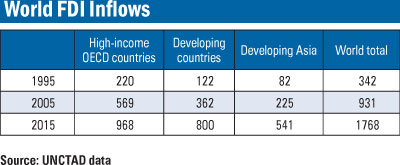

I have two points to elaborate: The first, there has been a massive increase in FDI flows over the past 2-3 decades, which can be termed as an “exponential growth.”

The second, there has been a significant diversion of growing FDI flows to developing countries in Asia since the turn of the century. Both points are good news for developing nations in Asia that are prepared to host growing FDI flows.

Until the mid-1990s, the total amount of world FDI flows was limited to $200-$300 billion. But it continued to grow and, after 2006 it was well above $1 trillion reaching its historical record of $2 trillion in 2007.

Until the turn of the century, World FDI flows were largely a business among rich countries; they flowed from rich countries and flowed into rich countries. In 2000, less than 20 per cent of world FDI flowed into developing countries. Since then during the past 16 years, FDI flows have increasingly diverted to developing countries. During the period from 2008-2015, every year over 45 per cent of world FDI flowed into developing countries, while Asia continued to be the most attractive region for FDI flows.

What made the difference?

The most fundamental reason to the growth of FDI flows and their diversion into developing countries is the global economic downturn which emerged in the US, EU and Japan. While during economic recessions capital starts flowing away, for the same reason the recession becomes steeper turning into a crisis.

Therefore, the economic slowdown in rich countries that started since the 1980s and ended with a global economic crisis in 2008-2009, has much to do with their capital outflows too. The policy failures and speculative attacks were products of this long-term recession or the business cycle rather than the causes of it.

Trade liberalisation and outsourcing

However there were other factors which facilitated growing capital outflows. Developing countries increasingly adopted liberalisation policy reforms in accommodating FDI flows from advanced countries. At the same time, technological advancement in information and communication as well as travel and transportation facilitated businesses to improve the cost advantage of new modes of production.

Multinational corporations played a bigger role in growing FDI outflows. They had been involved in another technological advancement; that is the slicing of their production processes and outsourcing the production of parts and components as well as their assembling among developing countries. This is why today’s manufacturing products are “made in different countries” rather than in one particular country.

(In US$ billion)

After the global economic crisis, there are tendencies in rich countries to reverse the process. In fact the US under its new administration has adopted extensive policies to reverse its capital outflows, while its FDI inflows have also grown during the past three years. Even with this tendency, today’s FDI flows in the world are significantly massive and measure in trillions of dollars.

FDI: Key source of financing

For developing countries too, FDI provides the key source of financing development. In the good old days, capital accumulation was from domestic savings so that development needed hundreds of years. Today with FDI flows, a developing country can leap forward to be a rich country in just 20 years! And, unlike inadequate domestic savings, there is no shortage of investment funds in the world.

Investment funds are already accumulated in billions and trillions of dollars in the global financial centres in looking for better locations. The problem is that FDI flows seek better locations for investment so that they do not flow everywhere.

FDI has other advantages too. As the term foreign direct investment implies, FDI comes with management as a package. It already includes management practices, technological know how, market access and other business links. Apparently, developing countries do not have to worry about their limited capacity in all these key areas of business.

Sri Lanka: Show the potential

Sri Lanka! Show that this is the best location for investment during the “best time” of global FDI flows. Be competitive in every way – policies, politics and rule of law. And let that competitiveness be projected through numbers in international reports. FDI could be the key source of financing Sri Lanka’s development at its early stages of takeoff.

(The writer is a Professor of Economics at the Colombo University)