(Bloomberg) Emerging Markets Shrug Off Crises For Best Gains in Eight Years

-

Assets defied missiles, Trump and Venezuela crisis in 2017

-

China’s debt crackdown, elections to be key into next year

2017 is set to go down as the year when easy monetary policy and budding global growth came together to deliver blockbuster returns for the world’s emerging markets.

Currencies and stocks in developing economies are on track for their biggest rallies in eight years as even the riskiest markets shrug off crises and threats to deliver gains for investors.

Bonds, too, have had a good run, with local-currency emerging-market debt returning the most since 2012 amid the loose policy environment.

From North Korea’s missile power plays to Venezuela’s debt default, it’s been an event-filled year in developing markets, kicked off by anxiety over U.S. President Donald Trump’s protectionist trade rhetoric. But investors have looked beyond the tension to focus on the positives in 2017, with the sturdy growth picture deflecting most of the shocks.

Whether that resilience will persist in 2018 is less certain, with more tightening from the Federal Reserve and ongoing political risk looming on the horizon.

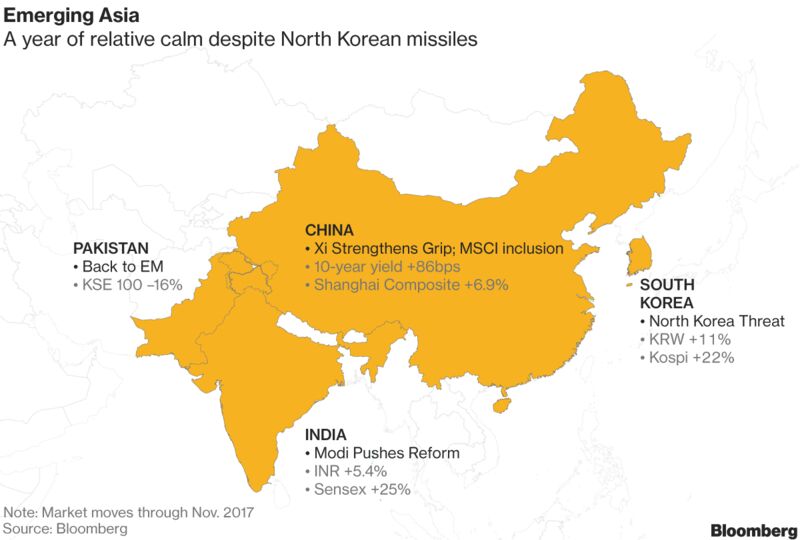

Asia, home to the biggest economy among developing nations, saw its fair share of market-moving events this year. Here’s how some of them panned out:

China: Xi’s Year

- The deleveraging campaign led by President Xi Jinping — who cemented his status as the nation’s strongest leader in decades at the 19th Communist Party congress in October — influenced market sentiment throughout the year. The campaign to reduce debt levels and tackle systemic risk is now being intensified, and is likely to become even more of a factor for assets next year.

Korean Peninsula

- “Rocket Man” — as Trump dubbed North Korea’s leader Kim Jong Un — rattled the world with more than a dozen missile tests in 2017. Kim’s actions set off a war of words with the U.S. president, who has expressed exasperation at the regime’s pursuit of nuclear weapons in the face of global sanctions and condemnation. With Pyongyang now saying its state nuclear force is complete, the tension will likely continue into 2018 as the country angles for dialogue.

MSCI Upgrades

- China’s domestic stocks won a significant seal of approval from MSCI Inc., the world’s biggest index compiler, this year. The admission of some large caps — due to take place in 2018 — gave the market a stamp of credibility, opening it up to a segment of investors that may have had little exposure to the world’s second-biggest economy.

- Pakistan was also restored to emerging-market status by MSCI in May, only to see stocks plummet as a political corruption scandal triggered foreign selling.

India: Ratings Boost

- Prime Minister Narendra Modi’s reform push started to bear fruit in 2017. In November, Moody’s Investors Service raised India’s credit rating for the first time in 14 years after Modi overhauled the tax system, introducing a goods and services levy in July. The government also said it would inject an unprecedented 2.11 trillion rupees ($32 billion) into struggling state-run banks over the next two years to revive growth.

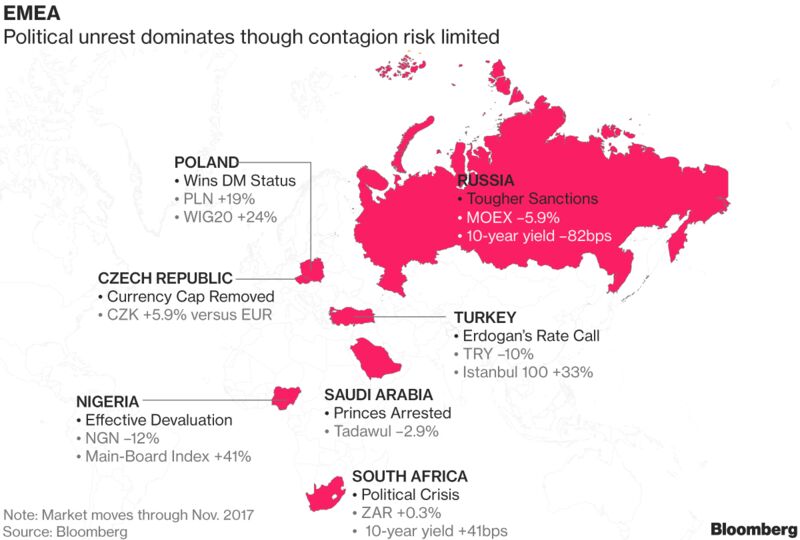

In Eastern Europe, the Middle East and Africa, the 2017 story was largely dominated by political crises.

South Africa: Foreign Exodus

- The reaction in South Africa’s assets was abrupt when President Jacob Zuma firedFinance Minister Pravin Gordhan in March. Foreign investors dumped the rand so quickly that it wiped out its gains for the year in about a week. The nation has since lost its foreign-currency investment grades from Fitch Ratings and S&P Global Ratings, and economic growth has stalled. Political tension has only worsened amid claims of mismanagement and corruption in Zuma’s administration.

Saudi Arabia: Shock Arrests

- It’s been a busy year for Saudi Arabia. Not only did 2017 see the kingdom start overhauling an economy that has relied almost exclusively on oil revenue for decades, it also saw a swathe of billionaires and princes arrested as part of a supposed crackdown against corruption. The country also boycotted neighboring Qatar. Rising political risk in the region has outweighed the government’s attempts to attract more foreign investors to its stock market, a situation that’s likely to persist into 2018.

Turkey: Political Interference

- While President Recep Tayyip Erdogan won a referendum ratifying the supremacy of his rule in April, deteriorating relations with the U.S. and EU weighed on the lira as 2017 wore on. Erdogan also criticized the central bank in November, saying it was on the “wrong path” in tackling soaring inflation, triggering the lira’s plunge to a record low. It’s the worst-performing emerging-market currency this year.

Czech Republic: Currency Gains

- The Czech central bank ended its cap on the koruna in April, allowing the currency to rise more than 5 percent versus the euro and 18 percent against the dollar this year, the most among emerging-market currencies. The advance has been supported by a robust economy and the prospect of more interest-rate hikes into 2018.

Nigeria: FX Reform

- Nigeria, Africa’s largest economy, came as close to a free float of its currency as it’s probably going to get, for now. The central bank introduced the so-called Nafex window in April — an alternative exchange rate for investors — where the naira has been allowed to fall to rates seen on the black market. About $18 billion of trades had been conducted via the window through the end of October.

Poland: New Status

- Index firm FTSE Russell upgraded Poland to a developed stock market in September, but politics has taken center stage in 2017. Since gaining power two years ago, right-wing populists have soured relations with Germany and France and challenged the European Union’s rule of law by overhauling the country’s judicial system. Meantime, domestic demand saw Poland’s economic growth quicken to the fastest pace since 2011 in the third quarter, boosting stocks.

Russia: Sanctions Bite

- Even as benchmark bond yields have held near the lowest level since May, the threat of new sanctions against Russia has hung over debt markets. The U.S. Treasury is preparing a report on the potential impact of extending the penalties to sovereign ruble notes. Markets took a hit in July after the U.S. toughened its existing sanctions against Moscow, which were signed into law by Trump in August.

For Latin America though, 2017 was more of a mixed bag. While many of Trump’s threats on trade failed to materialize, Venezuela’s default reverberated through the emerging-market universe.

Here are some high-lights and low-lights from the year:

Brazil: Election Focus

- President Michel Temer’s efforts to trim the budget deficit continued to propel Brazilian stocks to new record highs, along with evidence of rebounding activity. After successfully putting in place new labor laws, Temer is now trying to gather support for an overhaul of the pension system before the end of the year. While all that has supported markets, the president also faced allegations of corruption earlier in 2017. Uncertainty around next year’s presidential election should continue to be a key market driver, with candidates favored by investors trailing in opinion polls.

Mexico: Trump and Nafta

- With Trump’s trade threats remaining just that for the first half of 2017, investors started to downplay the risk of Nafta being dismantled, spurring the Mexican peso to lead emerging-market gains. While the peso has pulled back since then on fears of a populist shift in 2018’s presidential election, the currency has remained in the top 10 in the year-to-date rankings. Talks on revamping the North American Free Trade Agreement are under way in Washington this week, with Goldman Sachs Group Inc. saying a U.S. withdrawal from the deal looking more likely than not.

Venezuela: Debt Disaster

- Following months of protests and instability, the government’s decision to restructure its debt caused sovereign notes and bonds of Petroleos de Venezuela SA to tumble in early November. A resolution to the situation will be challenging because of U.S. sanctions that restrict investors from engaging with some top officials and purchasing new debt. Venezuela’s currency is also in freefall, spurring President Nicholas Maduro to float the idea of creating a “petrocurrency” to beat the financial blockade.

Argentina: Some Redemption

- Argentine assets made a comeback this year as President Mauricio Macri forged ahead with plans to narrow the fiscal deficit. Going forward, he has pledged to unravel some of the protectionist policies of the former government and is planning to reform the tax and pension systems.

— With assistance by Yumi Teso, Hannah Dormido, Dana El Baltaji, Aline Oyamada, Alexander Nicholson, Wojciech Moskwa, Paul Wallace, Ksenia Galouchko, and Konrad Krasuski

Source: Boomberg

Image Courtesy: globalriskinsights.com