Auditor General drops bombshell

By Chathuri Dissanayake

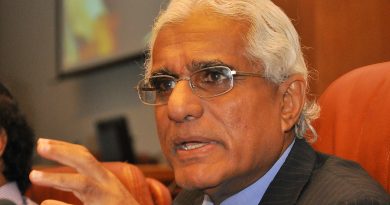

Government institutions have engaged in continuous “window dressing” of financial records to underreport national debt and bypass borrowing limits imposed by debt management regulations, Auditor General Gamini Wijesinghe revealed yesterday.

Taking the balance sheet of the Finance Ministry as an example, Wijesinghe said data presentation has been manipulated to avoid presenting the total amount under ‘Consolidated Fund – Accumulated Deficit’.

“If you go through the balance sheet of the Finance Ministry, you will see what we call balance sheet window dressing, they have presented in the balance sheet in a way that we cannot get a true reading, to give a positive,” he said.

“Although there is a line in the balance sheet called ‘Investment on Borrowings’ they have already accepted in writing that there is no such account. It is a dummy account,” he said.

Auditor General has given a qualified opinion on Finance Ministry final accounts from years 2013 to 2016. To bypass the regulation in Fiscal Management (Responsibility) Act imposing a ceiling on national debt to be 80% of GDP, officials in the previous government kept loans out of the balance sheet of the Finance Ministry, and instead instructed different institutions to obtain loans individually.

“During that time the Finance Ministry secretary advised the officials, secretaries of ministries to keep certain loans out of the balance sheet. Even certain loans which were not possible to be kept out of Finance Ministry balance sheet were transferred to other institutions which is illegal,” Wijesinghe said.

The practice has led to lack of records and proper monitoring of loans taken, said Wijesinghe adding that Government is not able to assess exactly how much debt Sri Lanka is in at the present.

“It is such a mess that, if we start to clear the mess now, maybe in about ten years we will be able to get a proper idea,” he said.

“Some loans we don’t even know if they have been paid in full or not, as we have been paying instalments and interest but proper records have been kept.

To date the Auditor General’s Department has identified loans amounting to Rs. 826 billion which have been taken off the balance sheet in the Finance Ministry balance sheet, when the total loans payable as per 2016 was at Rs. 8861 billion. This includes the Rs. 116 billion loan taken to finance Mattala Airport construction, three loans taken to finance construction of Hambantota phase I, II and extra work amounting to Rs. 142 billion and Norochcholai power plant phase I and II Rs. 166 billion.

Apart from this, the Road Development Authority has debt totalling to a staggering Rs. 136 billion while the Pensions department owes Rs. 37 billion. Last year alone, the Pensions department has paid Rs. 1.4 billion as interest, but has no record as the unit does not maintain a balance sheet, Wijesinghe said.

“This is all we can say now, there are loans totalling to trillions, which we will uncover as we go on. The main one is the bond. The Finance Ministry does not record the face value of the bond issued, but when it matures we have to pay the amount. But this is not in our records now, and it is difficult to rectify this immediately,” he said.

The gravity of Sri Lanka’s indebtedness is heightened as the asset base has not grown in-line with the increase in national debt over the years. According to Central Bank figures, loans payable as at 2017.11.30 are Rs. 10 trillion while Finance Ministry records a total national debt of 8.860 trillion as at 2016.12.31. But the assets base has only grown to 1.1 trillion, according to Finance Ministry balance sheet as at 2016.12.31.

“It is a grave concern that the assets have not grown compared to the growing debt. It is ok to obtain loans as long as it is invested well and not used for recurrent expenditure. But we see that the loans have been used to cover budget deficit and for recurrent expenditure,” the Auditor General said.

Wijesinghe also highlighted that the investments recorded each year has been lower than the loans taken the same year. The investments have included social welfare expenditure awarded to government institutions and provincial authorities, which according to him are recurrent expenditure items. This increase is reflected in the increase in per capita debt to Rs. 417,913 in 2016 from Rs. 124,711 in 2006, he said.

Secretary mafia blocks Audit bill: AG

The Auditor General yesterday slammed the “secretary mafia” for delaying the awaited audit bill, which has been over a decade in the working.

“The audit bill is being blocked by the Ministry secretaries, the highest ranking mafia group in Sri Lankan Government service. They do whatever they need, and what will be a benefit for them. If they see anything as a challenge for them, then they won’t do it. When they read the audit bill they feel that it is an attack on themselves, the secretary thinks what will happen to himself and that is why he is trying to change those sections,” said Auditor General Gamini Wijesinghe.

The bill has shuttled between offices and has under gone amendments over 24 times, he said, adding that the Auditor General Department has come to a compromise with the requests made by the secretaries who also the designated Chief Financial Officers in the Ministry.

Wijesinghe also highlighted that the Audit Commission, which was established through the 19th amendment, is inactive without the Audit bill being passed through the act.

“I have repeatedly highlighted this to the Government. All I can do is to inform them of the situation and suggest that we prevent expenditure associated with the commission as it is unable to function without the act being implemented,” he said.